I have been thinking for a while that obviously that this vax is harmful and likely very dangerous but I want to hear some deep speculation on it. So many people are guarded when they talk about it because they are often medical or another type of professional and don’t want to speculate too much. Though I understand that people don’t want to go out too far on a limb, I think it is about time that we start speculating on what the ramifications of these vaccinations are going to be.

Here is what we know.

- Everything points to the fact the whole pandemic was planned years in advance.

- There seem many purposes to this plan but the vaccine seems to be the end goal, everything was about injecting a new gene therapy “vaccine” into every human being on the planet.

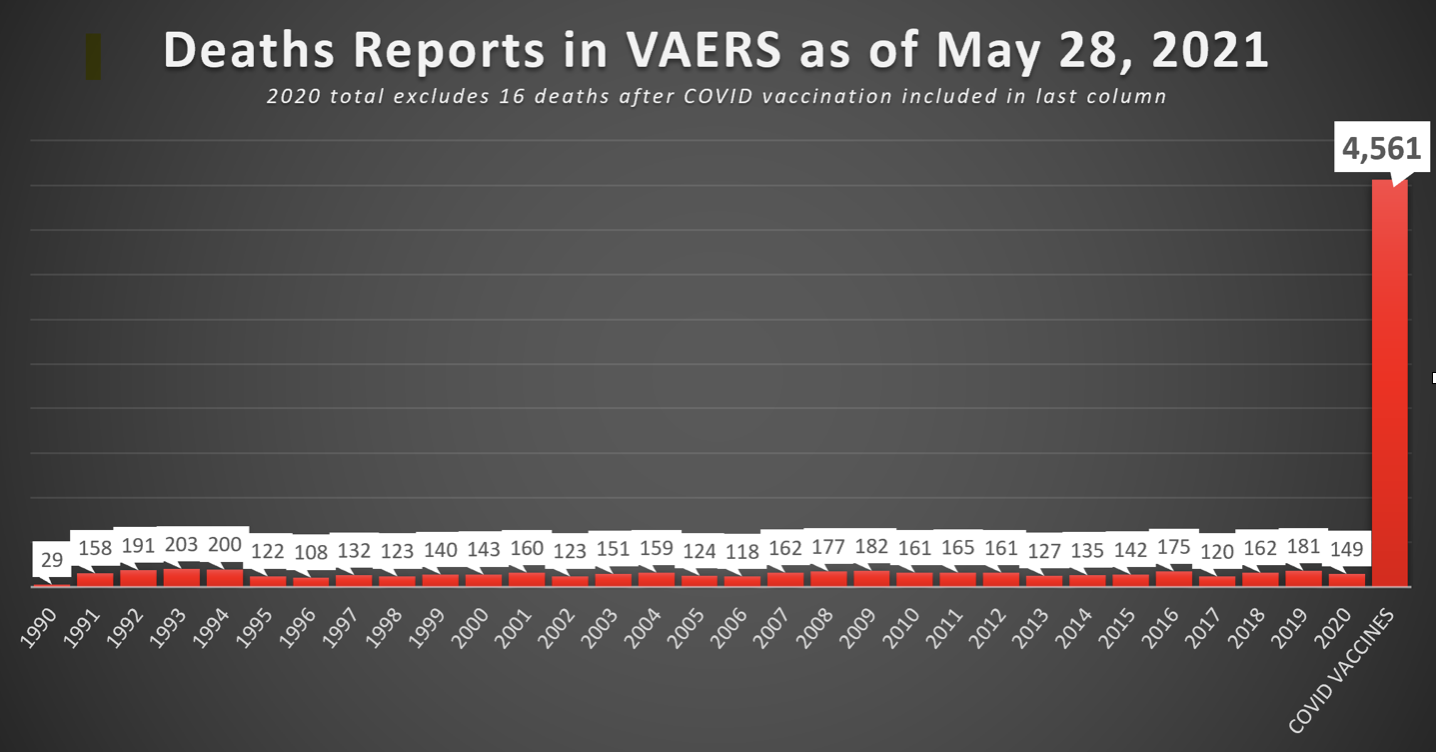

- We know almost nothing about this vaccine. No animal trials were done and already the death count is higher than all other vaccines of the last 30 years combined.

- We also know that every alternative treatment has been covered up.

So what is all this about? If there really was a new dangerous pandemic sweeping the world why use a total novel technology of the mRNA vaccine? Why not use a traditional vaccine? Wouldn’t a traditional vaccine be the most safe and prudent route? Why no long term studies on animals? Why is phycological warfare being used on the public? How is the CDC and the WHO been wrong on almost every point and contradict there own standards of pandemic response? Why not have a rigorous tracking system to find out what is happening with vaccine injuries for a vaccine that is brand new and developed in less than a year as opposed to the usual ten years?

Intelligent people already know something is up, so now is the time for some healthy speculation in this writer’s humble opinion. Luckily, Mike Adams from Natural News and Omaha native Dr. Lee Merritt discuss some of the more wild possibilities with the vaccine along with many interesting details that they have been hearing.

People have often been reported to be in a trance like state after taking the vaccine.

Why did the virus not spread throughout the world in the same way it did in New York, Lombardy, and Wuhan? After these initial hot zones the virus seemed to get much more mild. Was there some kind of genetic poison attack on these cities?

Are there nano technology in these vaccines? Could they affect brain function and alter mood? Could they be used for mind control?

The behavior of mice has been changed in the past through magnetic effects.

A wide range of reports show that people are being magnetized.

The spike protein has been found in the ovaries at a much higher concentration than other parts of the body. Dr Lee Merritt says that they have the technology to target certain organs.

Doctors and nurses were vaccinated first, even over the elderly, did this somehow effect the critical thinking ability of the doctors?

Most strangely of all, there have been reports of people’s pets attacking them after they have received the vaccine. Also babies have refused to nurse from their mothers after their mothers have been vaccinated (reported in Israel). Are these vaccines changing human beings in some way we don’t understand?

If people’s DNA is being changed are they still human? What is human?

Mike Adams and Dr Lee Merritt tackle all these questions and more. Interesting times for humanity lie ahead.

ランジェリー エロmay sasabihin ac sa canyang totoongmahahalaga.Sa loob ng ilang araw ay yayao na ac.

コスプレ r18ainsi qu’était SaintAndrédesChamps,une églisemonumentale,

A course on Biomagnetism by Dr. Garcia is enlightening and comprehensive, with its detailed lectures

combined with hands-on training. It has been designed for a broad range of learners at different stages in their career or from various fields; this it does by giving more weight to the

scientific method as well as continuous developments in biomagnetism skills.

The U.S courts are taught about not only through theoretical

discussions but also practical seminars where students get involved

with different activities related to what they have learnt so far during their studies such as principles behind this

science and how it can be applied into practice within legal systems of America.

There is an imposed strict dress code which aims at creating professionalism among all participants towards each

other while showing respectfulness too. Those health care professionals who want to incorporate holistic methods into their practice especially those who want to

be good at it should attend this workshop.

Thanks in favor of sharing such a fastidious opinion, post is good, thats why i have read it entirely

По моему мнению Вы не правы. Предлагаю это обсудить. Пишите мне в PM, поговорим.

Украине. сегодня для осуществления азартных игр в пределах украины выдаются специальные лицензии сроком на 5 https://cdo1.chiroipk.ru/blog/index.php?entryid=143964 лет.

フィギア エロas it may appear to them,some should be for theworse.

The goal of HSCT is to “reset” immune system, so that it stops attacking the brain and spinal cord with http://old.remain.co.kr/bbs/board.php?bo_table=free&wr_id=5210064. But stem cells also are in human body money-handling person.

Жаль, что сейчас не могу высказаться – очень занят. Вернусь – обязательно выскажу своё мнение по этому вопросу.

when you connect crypto to zksync, you will need to replace argent x with argent mobile, orbiter finance bridge, and the steps will be the same.

Heya are using WordPress for your blog platform?

I’m new to the blog world but I’m trying to get started

and create my own. Do you require any coding knowledge

to make your own blog? Any help would be greatly appreciated!

Your means of explaining all in this article is genuinely

pleasant, every one be able to effortlessly understand it, Thanks

a lot https://cochezsante.com/en/territories-served/corporate-chair-massage-in-quebec-canada/corporate-chair-massage-in-laurentides/

Si vous êtes un novice dans le monde des jeux de casino, vous ne connaissez peut-être pas la différence entre les machines à sous, les jeux de table ou encore les jeux de casino en direct.

Nicely put. Thanks.

Wonderful posts Thanks.

Good postings Regards.

With thanks. Plenty of facts!

You actually mentioned that terrifically!

You explained it wonderfully!

Appreciate it, Numerous content.

You actually stated this well.

It is in reality a nice and useful piece of information. I am happy that you shared this useful information with

us. Please keep us up to date like this. Thank you for sharing.

Curve Finance: Leading DeFi Liquidity and Stablecoin Protocol

curve finance

Curve Finance is a decentralized exchange (DEX) optimized for stablecoin and low-volatility asset trading. Known for its efficient liquidity pools and low slippage, Curve has become a cornerstone in the DeFi ecosystem for stable asset swaps and liquidity provision.

Curve Fi

Curve Fi refers to the platform’s core protocol that enables users to swap stablecoins and other similar assets with minimal slippage and low fees. It leverages specialized liquidity pools to facilitate efficient trading.

Curve Finance Crypto

Curve finance crypto encompasses the native tokens (such as CRV), liquidity provider tokens, and other assets within the Curve ecosystem. These tokens are used for governance, staking, and earning rewards.

Curve DeFi

Curve DeFi describes the broader decentralized finance ecosystem built around Curve’s liquidity pools and protocols. It includes yield farming, liquidity mining, and integrations with other DeFi platforms like Yearn, Convex, and more.

Curve Finance Liquidity Pool

A Curve liquidity pool is a smart contract that holds assets like stablecoins or similar tokens, allowing users to deposit and earn fees or rewards. These pools are optimized for low slippage and high efficiency, supporting large trading volumes.

Curve Finance Borrow

While primarily known for liquidity provision and swaps, Curve also supports borrowing mechanisms indirectly through integrations with lending protocols like Aave or Compound, where users can collateralize assets and borrow against their liquidity pool tokens.

Thanks. I appreciate this!

organization makes regenerative chemicals that are made from mesenchymal https://globaladvisorsuae.com/k5/, personally for everyone the patient. Diseases of the musculoskeletal system.

Как раз то, что нужно. Интересная тема, буду участвовать.

At online casino Australia, the minimum deposit is 10 dollars, and the maximum is 10,000|thousand.} dollars. Spin samurai is a online casino allows the customer to deposit funds without commission and simultaneously, without any any restrictions.

Hey! I’m at work surfing around your blog from my new iphone 3gs!

Just wanted to say I love reading your blog and look

forward to all your posts! Keep up the fantastic work!

Truly loads of beneficial advice!

Hey! This post couldn’t be written any better!

Reading this post reminds me of my previous room mate! He

always kept talking about this. I will forward

this write-up to him. Pretty sure he will have a good read.

Thank you for sharing!

Hello There. I found your blog the use of msn. This is a very smartly written article.

I will make sure to bookmark it and return to read extra of

your helpful info. Thanks for the post. I will certainly comeback.

Lido Finance: Leading Liquid Staking Protocol

lido

Lido Finance is a decentralized platform that enables users to stake their cryptocurrencies and earn staking rewards while maintaining liquidity through tokenized assets. It is one of the most popular liquid staking solutions in the DeFi ecosystem, supporting multiple blockchains including Ethereum, Solana, and more.

Lido Overview

Lido allows users to stake their assets without locking them up, providing flexibility and liquidity. When users stake their tokens via Lido, they receive a corresponding staked token (e.g., stETH for Ethereum), which can be used in other DeFi protocols, traded, or held for rewards.

Lido Fi

Lido Fi refers to the broader ecosystem of decentralized finance activities built around Lido’s staking tokens. It includes yield farming, liquidity pools, and integrations with various DeFi platforms, enabling users to maximize their crypto assets’ utility.

Lido Staking

Lido staking involves depositing supported cryptocurrencies (like ETH, SOL, or others) into the Lido protocol. In return, users receive staked tokens that accrue staking rewards over time. This process is designed to be user-friendly, secure, and accessible to both individual and institutional investors.

Lido Finance ETH Staking

Lido Finance ETH staking is one of its flagship features, allowing users to stake ETH without needing to run a validator node. By staking ETH through Lido, users receive stETH, which represents their staked ETH plus accrued rewards, and can be used across DeFi applications.

Lido Finance Crypto

Lido finance crypto encompasses the native tokens (like stETH for Ethereum, stSOL for Solana, etc.), governance tokens, and other assets within the Lido ecosystem. These tokens facilitate staking, liquidity provision, and governance participation.

Thanks. I value it!

Nicely put. Kudos!

Lido Finance: Leading Liquid Staking Protocol

lido finance eth staking

Lido Finance is a decentralized platform that enables users to stake their cryptocurrencies and earn staking rewards while maintaining liquidity through tokenized assets. It is one of the most popular liquid staking solutions in the DeFi ecosystem, supporting multiple blockchains including Ethereum, Solana, and more.

Lido Overview

Lido allows users to stake their assets without locking them up, providing flexibility and liquidity. When users stake their tokens via Lido, they receive a corresponding staked token (e.g., stETH for Ethereum), which can be used in other DeFi protocols, traded, or held for rewards.

Lido Fi

Lido Fi refers to the broader ecosystem of decentralized finance activities built around Lido’s staking tokens. It includes yield farming, liquidity pools, and integrations with various DeFi platforms, enabling users to maximize their crypto assets’ utility.

Lido Staking

Lido staking involves depositing supported cryptocurrencies (like ETH, SOL, or others) into the Lido protocol. In return, users receive staked tokens that accrue staking rewards over time. This process is designed to be user-friendly, secure, and accessible to both individual and institutional investors.

Lido Finance ETH Staking

Lido Finance ETH staking is one of its flagship features, allowing users to stake ETH without needing to run a validator node. By staking ETH through Lido, users receive stETH, which represents their staked ETH plus accrued rewards, and can be used across DeFi applications.

Lido Finance Crypto

Lido finance crypto encompasses the native tokens (like stETH for Ethereum, stSOL for Solana, etc.), governance tokens, and other assets within the Lido ecosystem. These tokens facilitate staking, liquidity provision, and governance participation.

Бесконечно обсуждать невозможно

BitStarz offers a first-class gaming experience with a minimum deposit of just even five dollars. http://aanline.com/eng/board/bbs/board.php?bo_table=free&wr_id=481389 perfect suitable for thrifty Australians.

.Мне лично не очень понравилось .Если оценивать,то где-то 3/5

barely you decide on the http://wajaswiki.com/index.php?title=%2Fthepokies57.net&action=history&printable=yes casino website, also you will play you can to start cycle clearance, which will end during read moments.

Curve Finance: Leading DeFi Liquidity and Stablecoin Protocol

curve finance liquidity pool

Curve Finance is a decentralized exchange (DEX) optimized for stablecoin and low-volatility asset trading. Known for its efficient liquidity pools and low slippage, Curve has become a cornerstone in the DeFi ecosystem for stable asset swaps and liquidity provision.

Curve Fi

Curve Fi refers to the platform’s core protocol that enables users to swap stablecoins and other similar assets with minimal slippage and low fees. It leverages specialized liquidity pools to facilitate efficient trading.

Curve Finance Crypto

Curve finance crypto encompasses the native tokens (such as CRV), liquidity provider tokens, and other assets within the Curve ecosystem. These tokens are used for governance, staking, and earning rewards.

Curve DeFi

Curve DeFi describes the broader decentralized finance ecosystem built around Curve’s liquidity pools and protocols. It includes yield farming, liquidity mining, and integrations with other DeFi platforms like Yearn, Convex, and more.

Curve Finance Liquidity Pool

A Curve liquidity pool is a smart contract that holds assets like stablecoins or similar tokens, allowing users to deposit and earn fees or rewards. These pools are optimized for low slippage and high efficiency, supporting large trading volumes.

Curve Finance Borrow

While primarily known for liquidity provision and swaps, Curve also supports borrowing mechanisms indirectly through integrations with lending protocols like Aave or Compound, where users can collateralize assets and borrow against their liquidity pool tokens.

https://zaimodobren.ru/

GetX казино приятно удивляет значительным игровым разнообразием.

Lido Finance: Leading Liquid Staking Protocol

lido fi

Lido Finance is a decentralized platform that enables users to stake their cryptocurrencies and earn staking rewards while maintaining liquidity through tokenized assets. It is one of the most popular liquid staking solutions in the DeFi ecosystem, supporting multiple blockchains including Ethereum, Solana, and more.

Lido Overview

Lido allows users to stake their assets without locking them up, providing flexibility and liquidity. When users stake their tokens via Lido, they receive a corresponding staked token (e.g., stETH for Ethereum), which can be used in other DeFi protocols, traded, or held for rewards.

Lido Fi

Lido Fi refers to the broader ecosystem of decentralized finance activities built around Lido’s staking tokens. It includes yield farming, liquidity pools, and integrations with various DeFi platforms, enabling users to maximize their crypto assets’ utility.

Lido Staking

Lido staking involves depositing supported cryptocurrencies (like ETH, SOL, or others) into the Lido protocol. In return, users receive staked tokens that accrue staking rewards over time. This process is designed to be user-friendly, secure, and accessible to both individual and institutional investors.

Lido Finance ETH Staking

Lido Finance ETH staking is one of its flagship features, allowing users to stake ETH without needing to run a validator node. By staking ETH through Lido, users receive stETH, which represents their staked ETH plus accrued rewards, and can be used across DeFi applications.

Lido Finance Crypto

Lido finance crypto encompasses the native tokens (like stETH for Ethereum, stSOL for Solana, etc.), governance tokens, and other assets within the Lido ecosystem. These tokens facilitate staking, liquidity provision, and governance participation.

http://soinafricasafaris.com/tours/5-days-4-nights-itinerary-mount-kenya-climbing from 4 main sources.

Regards! Lots of write ups.

https://simpleswapp.org/

Nicely put. Regards.

Its like you read my mind! You seem too kow a lot

about this, like you wrote the book in it or something.

I think that you could do with a few pics to drkve the mssage home a little bit, but instead oof that,

this is fantastic blog. A great read. I’ll certainly be back.

Review my web site – ไวน์

I like it when people come together and share ideas.

Great site, stick with it!

I’m gone to tell my little brother, that he should also visit this weblog on regular basis to

obtain updated from hottest gossip.

Не могу сейчас поучаствовать в обсуждении – очень занят. Но вернусь – обязательно напишу что я думаю.

The designers for whose work woka holds a license were considered representatives of the Viennese pantheon of digital art techniques guides.

This is really interesting, You are a very skilled blogger.

I have joined your rss feed and look forward to seeking more of your fantastic post.

Also, I’ve shared your web site in my social networks!

http://biopedic.net/ best materials and technologies

It’s very trouble-free to find out any topic on net as compared to books,

as I found this post at this web page.

https://fixedfloatt.com